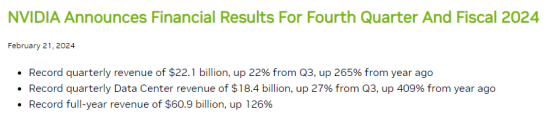

Following the announcement of Nvidia, a leading U.S. chip design giant, surpassing Wall Street's forecasts for its fourth-quarter earnings and revenue, and its projection of "continued growth" into 2025 and beyond, a collective surge was seen across AI and semiconductor stocks. Key suppliers and related companies, including Taiwan Semiconductor Manufacturing Company (TSMC) and others like Super Micro Computer, Dutch chip equipment maker ASML, competitors Advanced Micro Devices (AMD), and Arm Holdings, experienced varying degrees of stock price increases.

Image sourced from the internet

The demand for Nvidia's Graphics Processing Units (GPUs), crucial for powering AI booms such as the widely popular OpenAI's ChatGPT, has seen a significant uptick, leading to a 9% rise in Nvidia's stock price in extended trading. Additionally, memory chip manufacturers like Samsung Electronics and SK Hynix from South Korea also saw gains, driven by the high-performance chip demand for supporting large language models like ChatGPT.

Nvidia's CEO, Jensen Huang, in a post-earnings call, highlighted the favorable conditions for sustained growth, fueled by the rising demand for generative AI and a shift towards GPU accelerators in the industry. Analysts predict Nvidia's market share and profit margins will surpass expectations, underscoring its leadership in the tech sector.

To learn more, please follow the "career infinite" website.

We match you with top-quality mentors from major companies, offer 1-on-1 personalized career guidance, resume polishing, sharing of written and interview experiences, provide official internship certification, and three official referral opportunities, with an acceptance rate of over 90%. Don't miss out on this opportunity.

We will continuously update job trends and connect in real-time with high-quality mentor resources from major companies in artificial intelligence, internet, finance, biomedicine, consulting, accounting, media, and more, to safeguard your work and internships!